Why we built Forecash…

We needed a strategy for paying off our student loans.

Just out of graduate school, student loans were a burden, stacked on top of credit card debt.

There were times when we had $7 in our bank accounts and two days until our next paycheck.

The mainstream apps and advice just weren’t working.

We tried using Mint, but it took too much time to recategorize transactions, and it didn't even address the real problem. Yeah, we were spending, but we were only spending on the bare essentials anyway.

We tried a monthly budget, but every month was different. Unexpected dental and medical bills would pop up rendering any budget moot.

And we quickly discovered what living paycheck-to-paycheck means.

When you're working close to a zero balance, when you pay is just as important as how much you pay.

Buying a plane ticket could make a rent check bounce two or three months later, but putting off buying the ticket could make the price jump.

And so much for saving up for a six-month emergency fund.

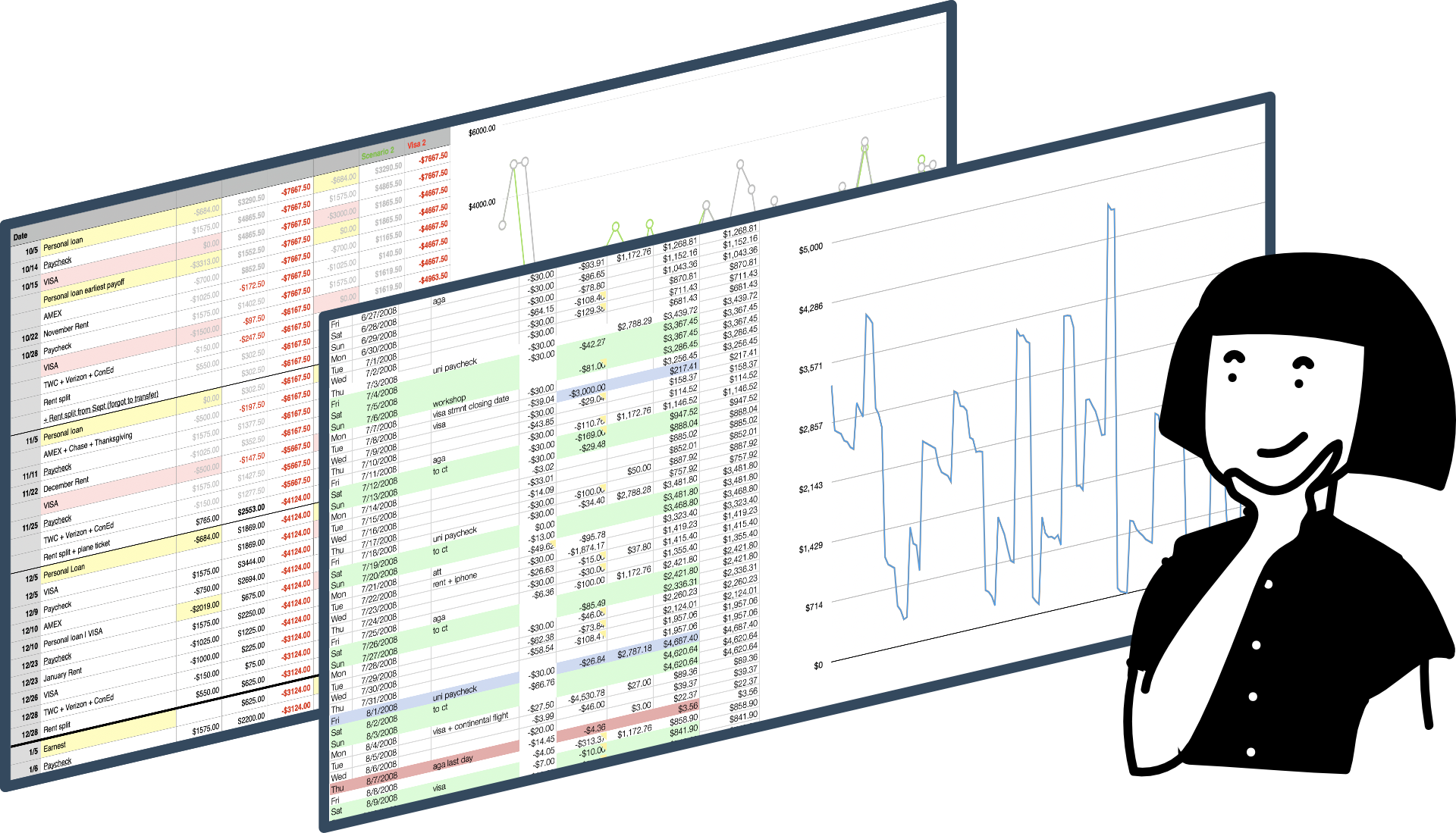

So we started making lots of spreadsheets.

And things started working…

As visual thinkers, this made it so much easier for us to understand our situation. We could anticipate when trouble might be coming and could move planned expenses around accordingly.

And it turns out, after getting loan payments under control, it all becomes about interest.

…but they were still spreadsheets.

Manual, tedious, brittle, quickly out of date,and hard to remember what magical formulaic incantation we needed to get our last week’s sheet to work.

So we built an app.

We discovered our friends were making similar spreadsheets, similarly difficult, similarly useful.

Our first attempt at an app was terrible, so we tried again, and we're admittedly still iterating and learning from our users, but Forecash is now here.