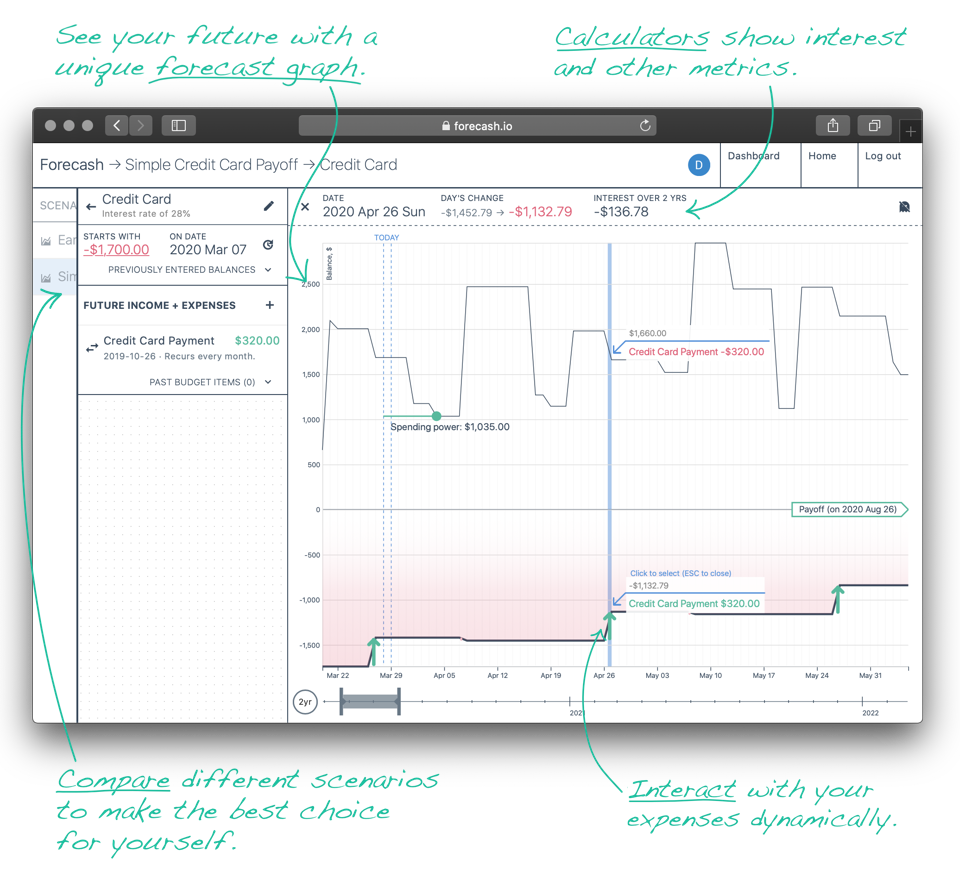

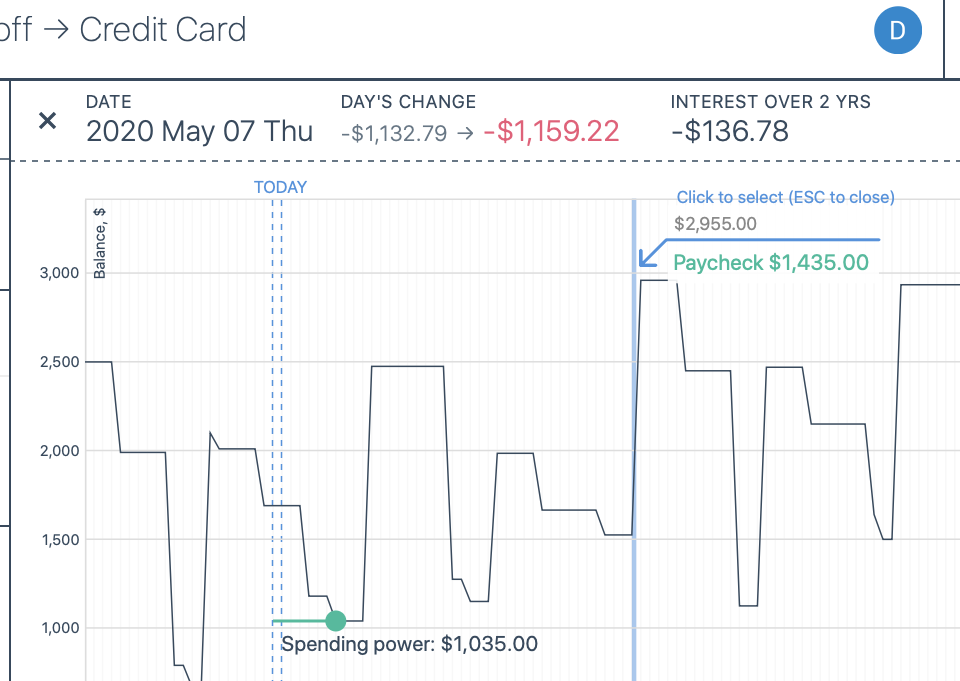

Forecash

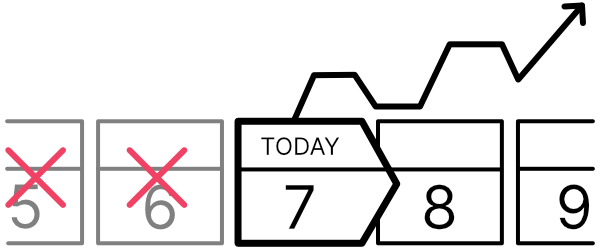

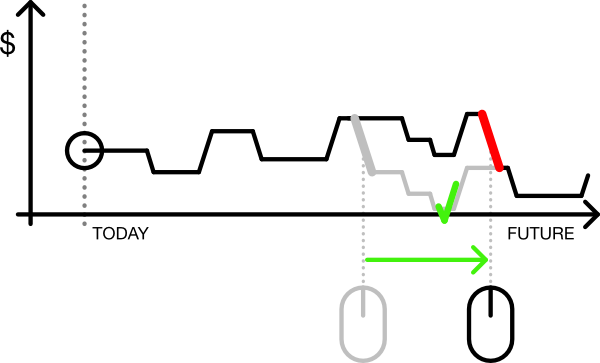

The next best thing to predicting the future of your money.

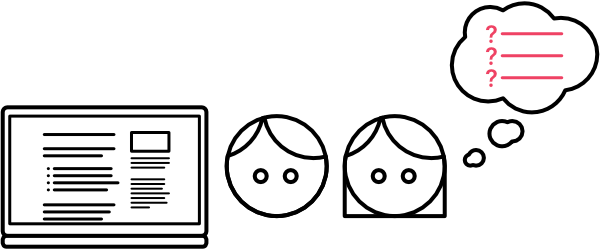

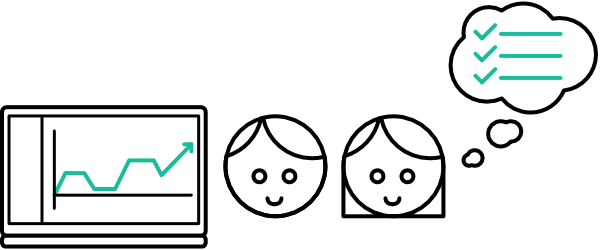

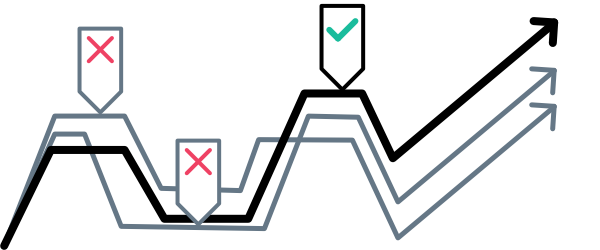

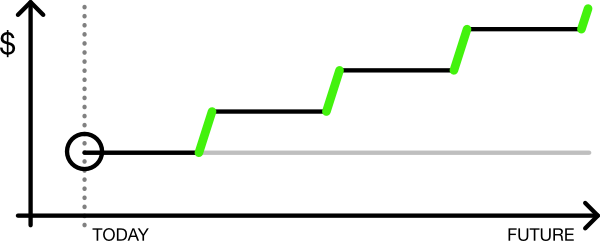

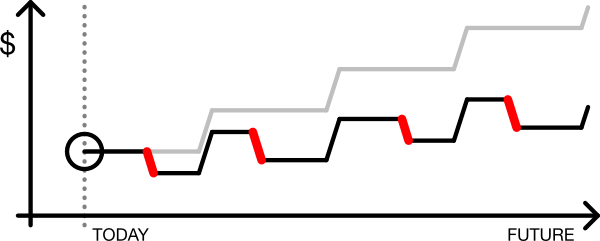

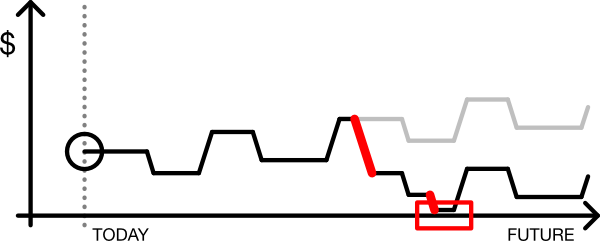

Instead of using apps that insist on over-budgeting your life and overanalyzing your mistakes, plan ahead with Forecash, which forecasts your cash flow and helps you make informed decisions about your finances.

Get Started